-

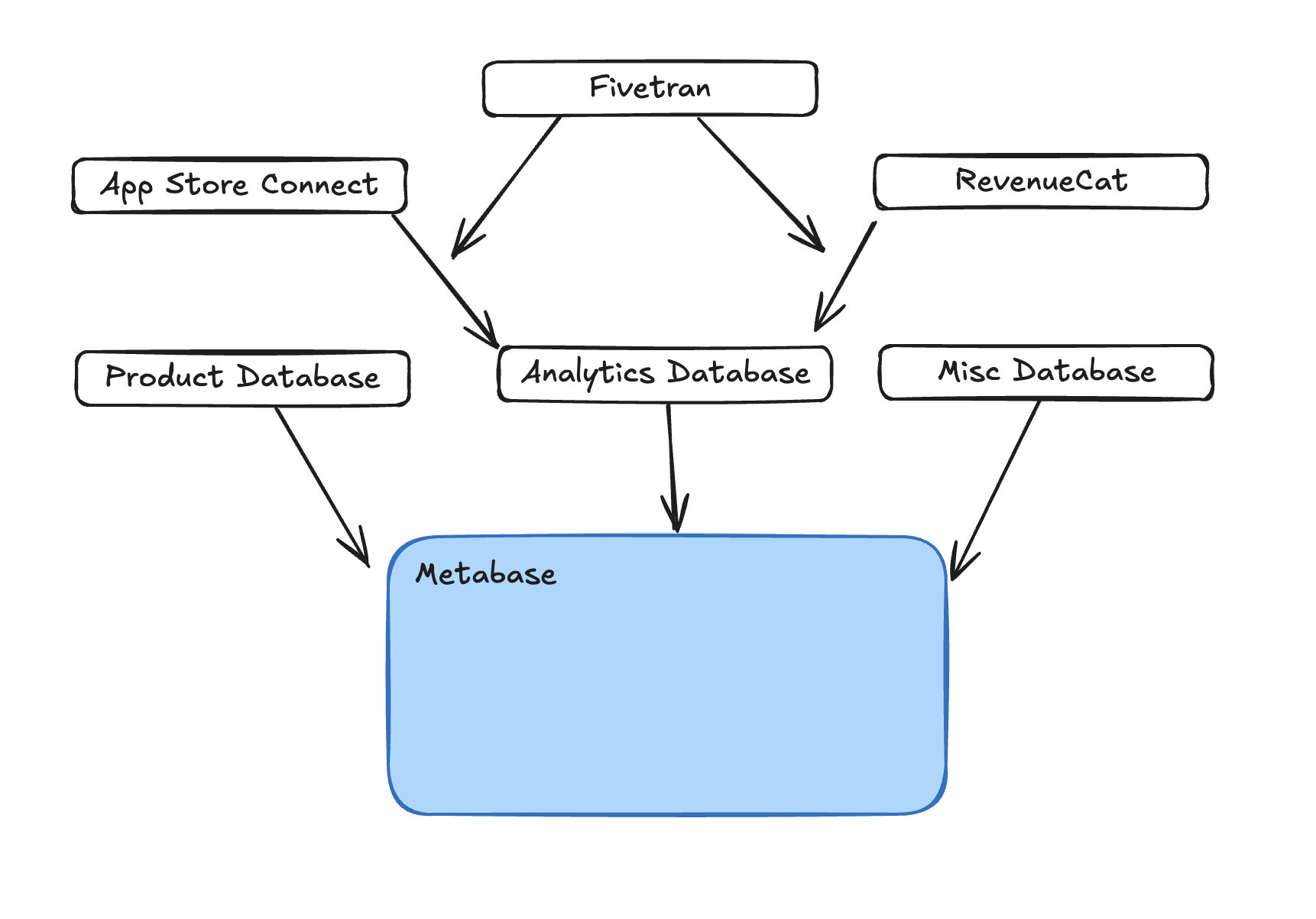

Data Setup

-

Explanations

-

Fivetran: This is not a data source. It's a tool we use to move data from external sources (App Store Connect, RevenueCat) into a postgres database.

-

App Store Connect: This is Apple. So it knows about installs, conversions and revenue.

-

RevenueCat: Tool we use to track our revenue

-

Superwall: Tool we use for Paywalls

-

Product Database: This is the app's backend. So we can use if for usage data (e..g how many people created a pledge or used chat), but it's also useful for registered users and active subscriptions.

-

Analytics Database: This is a postgres database we created solely to pipe data into using Fivetran, so that we could get our App Store Connect data in postgres.

-

Misc Database: We built a simple internal tool to track Video views across all of our creators. It's called "Misc" because we use it for various things.

-

-

Data Flow

-

-

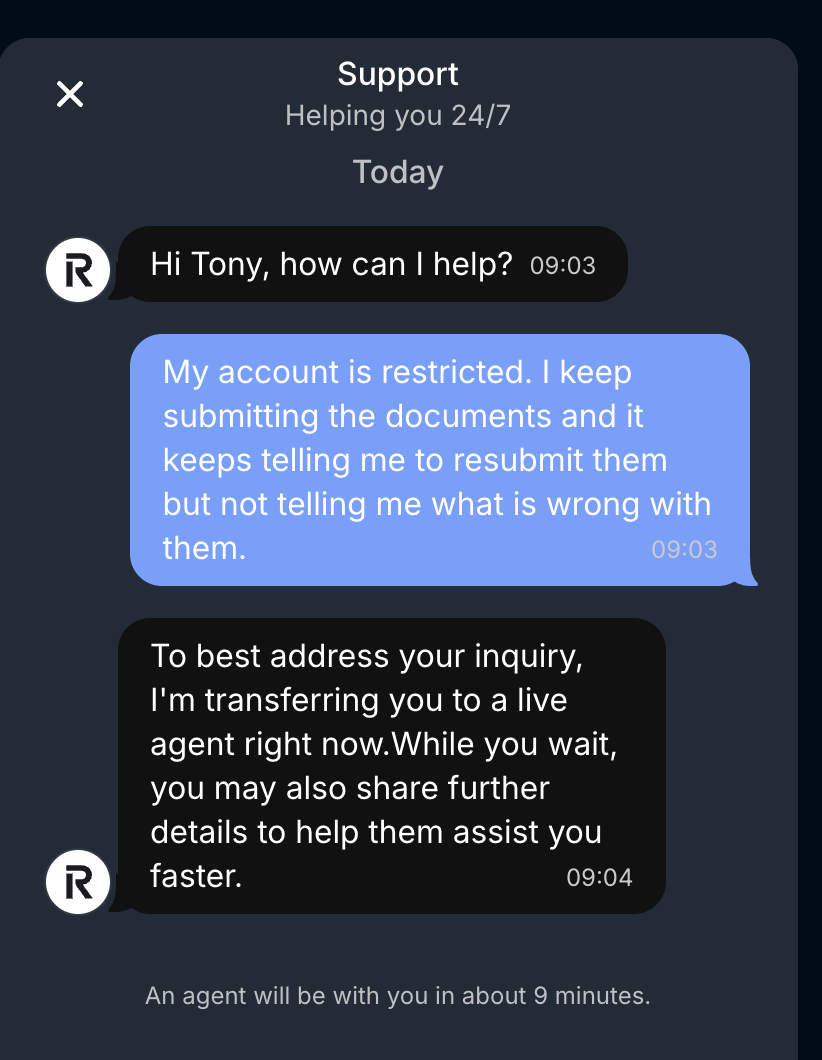

Revolut Business

-

Revolut business account for Fuse Holdings

-

The UI keeps asking us to re-submit the list of owners. We do that, then it updates saying our account is still restricted, with an undecipherable message. There's no way to speak to someone on the phone, and their minimum upgrade price is 750.

-

Their live chat is hidden behind several layers of help. When you get there, they put you on to someone with a 10 minute wait time. This person is actually helpful this time, and says they can't see the document I uploaded last week. I re-upload the document. They say it should be solved in a few hours.

-

-

-

Irish Dividend Saga - Government Side (Ireland & Holland)

-

Background: I realize with my Dutch setup, it's more tax beneficial to pay myself a dividend from my Irish company directly to myself in the Netherlands. So I attempt to change how I'm doing things.

-

Up Front Work

-

In order to prevent the Irish government from taking 25% of the payment, I have to submit a document that proves I pay tax in the Netherlands. This has to be a specific document I can only get from the Dutch government. I reach out to the Dutch government & they tell me it will take months to get the document.

-

Then, for each dividend payment

-

Irish Dividend Saga - Tax Firm Side

-

Background: I realize with my Dutch setup, it's more tax beneficial to pay myself a dividend from my Irish company directly to myself in the Netherlands. So I attempt to change how I'm doing things.

-

I tell my Irish tax advisor in an email. They ask to set up a call with one of their team. We do call number one & I explain the situation but seems like a complete waste of time. She sets up another call with the firm owner & obviously gives him some context - he comes in briefed. On call 2, he mocks me for believing there could be such a tax advantage. "Was your friend drunk when he told you this?", "I hear you think there's some all-you-can-eat tax buffet", "Don't believe everything you read on ChatGPT" - direct quotes from my meeting notes.

-

I'm stubborn so I continue digging and find out that I was right - the tax advantage does exist. I email the tax company and they completely gloss over their original advice, don't apologize etc

-

To prepare the dividend is somewhat messy because I have a hold-co structure with investors. So i have to email each of them, get them to sign a document and give me their bank account details. I ask the firm to help me with that email/admin because I'm not sure what the documents are and why they're needed - they decline to help with the email.

-

At some point we have a discussion on the financials & how the dividend works out versus paying myself through Dutch payroll. We are already paying this tax firm 8,000 per year for 2 entities, one of which has zero activity. I assume that them helping with my dividend is part of what I'm paying for. If it's not, when we're discussing the numbers I assume that if there's costs on their side, they'll mention them, as it's clearly material to whether the dividend makes sense financially. At no point do they mention any additional costs.

-

3 weeks later they send me an un-itemized invoice for 4,350. They seem to have included the calls that they asked for, including the one where they mocked me. I ask them to please tell me about costs up front next time - they don't acknowledge that email.

-

To be fair - the firm are detail oriented with the paperwork and making sure the regulatory boxes are checked. But the actual work required here is, from what I can tell - creating word documents for each dividend. Their fee for doing this is €4,350 for the initial work, and then €1,500 for every single dividend payment.

-

My Take: I shouldn't need an external firm to simply help me to pay myself a dividend in the first place. This should be part of a simple software tool given to business owners by the government. We should be able to see our shareholders, see their DWT exemption status, and click a button to inform the government of a dividend payment. There is no inherent complexity to understanding the logic - all of the complexity is administrative. We've had web software for 20 years, and my company collects and pays tens of thousands a year in tax revenue to the government (I don't even live in Ireland). And still the system carries so much complexity that an entire industry exists to navigate it.

-

Call With Ryan Thorpe

-

Ryan - the english guy we met at last night of Raga - linkedin

-

His background: Built a mobile app portfolio company - spent 10 years on it. Got it to a group of 25 apps collectively doing 8m ARR. Recently sold 80% of the apps & is now working on re-focussing - he wants to build something with the potential to be much bigger long term.

-

They seem like they had a super solid team. He shared a pitch deck they use to on-board their creators - link, and the system they built for onboarding creators and managing large amounts of videos, built on Airtable, which looked very thorough.

-

He also spoke about financing & liquidity - longer term they want to use the data to be able to offer financing to businesses, and to build a marketplace to buy & sell apps. Frankly seems like a lot to do well, but that's their play.

-

Their current focus is building a new product called Fload. In his words, it hooks up to all your systems and does 2 things: 1. Gives you a single place for dashboards & analytics, 2. Alerts you when metrics are moving in the wrong direction. We ran out of time but he asked that we do another call (with Faith) where he can onboard us & show us the product.

-

Full Notes on Granola